Payment Processing Solutions

Explore the Gateway

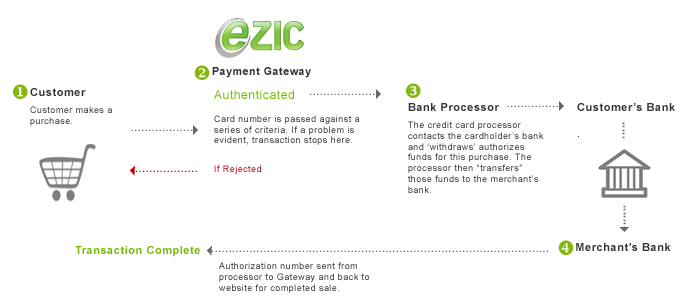

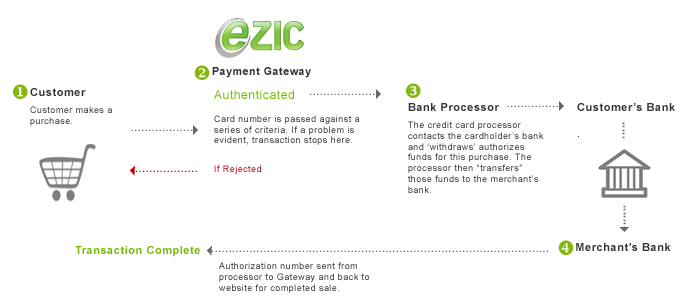

Payment Processing Diagram

As an ISO or Agent, one of your most important decisions is the selection of the gateway service provider that you recommend to your merchants. In an electronic transaction, the decision as to whether a transaction is fraudulent or not rests with the gateway and its fraud detection and prevention expertise.

A typical credit card transaction would proceed as follows, with the entire process taking two to three seconds:

- As a consumer, you pass your card to a merchant to pay for a product/service or enter the card number yourself at your favorite website. At that moment your credit card information is captured.

- Your information and the transaction amount are transmitted to a gateway where it is checked for authenticity. The card number is passed against a series of criteria: known fraudulent numbers lists, point of origin for high-risk countries, as well as a variety of merchant customizable parameters. If a problem is evident the transaction process stops here.

- If the information seems to be correct and no fraud is apparent, the information is passed to a credit card processor. The credit card processor contacts the cardholder's bank and "withdraws" authorizes funds for this purchase. The processor then "transfers" those funds to the merchants' bank completing the electronic processing of funds. Once this action is completed the processor sends an authorization code to the gateway. If there is an insufficient credit line available, the transaction is declined.

- On an approved transaction, the processor notifies the gateway of the authorization code. The gateway receives the code and communicates this code to the merchant. The purchase is made. The total transaction will be completed later in the day during batch settlements between financial institutions.

A debit card or e-check transaction is processed in a similar fashion, with the distinction being the evaluation of available funds versus credit line. In both cases digital information is captured, passed against fraud protection criteria, checked for available funds and accepted or declined, all in a matter of seconds.

Your gateway is the crucial link charged with authenticating information and accurately and smoothly passing all communication between the merchant and the processor. Selecting the correct gateway is crucial to your business.

Processing Solutions for Agents

Transaction Processing Options

- Virtual Terminals

- Batch Mode

- Hosted Payment Page

- Direct Mode Interface

- Direct Mode Batch Interface

Multiple Merchant Matrix

- Manage Multiple Bank Accounts Under One Gateway Account

- Configure Accounts by Load Balancing, Card Issuer, Priority, Transaction Type, or Site Tags

- Customizable Cascade Settings

Subscription/Membership Management

- Customizable Recurring Billing

- Tokenization

Stepdown Rebilling

Processing Solutions for Merchants

Our flexibility allows merchants to tailor their solution to create their own customized gateway.

Transaction Processing Options

- Virtual Terminals

- Batch Mode

- Direct Mode Interface

- Direct Mode Batch Interface

Ezic Hosted Payment Pages

- PCI Compliant Transaction Processing

- Format Page with Option-Based Selections

- Customize Page with Exact HTML Coding desired

Multiple Merchant Matrix

- Manage Multiple Bank Accounts Under One Gateway Account

- Configure Accounts by Load Balancing, Card Issuer, Priority, Transaction Type, or Site Tags

- Customizable Cascade Settings

Subscription/Membership Management

- Customizable Recurring Billing

- Tokenization

- Stepdown Rebilling

- Analyze Memberships

- Advanced Membership Reports

- Hotel Interchange Rate Support

- Up-Sell/Cross-Sell Support

EZICheck™

- Expand your Payment Offerings

- Comprehensive Daily Disbursements Report

Partners | Integrations | Customers

The addition of a shopping cart for a company's website can have undeniable benefits and increase their e-commerce sales to infinite heights.

- 1shop

- 3dCart

- Awesume Interactive

- Bitwise Software

- CartManager

- ClickCartPro

- Cool Cart

- Danise Website Designs

- DesignCart

- Evocative Commerce

- Hazel Enterprise

- Interchange

- Interspire

- iWorksite

- JAC 6

- KiskASP Shopping Cart

- LaGarde Storefront Shopping Cart Software

- Magento

- Make-A-Store, Inc.

- Miva Corp.

- My Web Site Tool

- Nascent Commerce

- Nelix, Inc.

- Next Technologies

- osCommerce

- Pinnacle Cart

- ProductCart

- QuickStore

- Sales Cart

- Shopify

- SmartWin Technology

- Squirrel Cart

- WooCommerce

- X-Cart

Processor Integrations

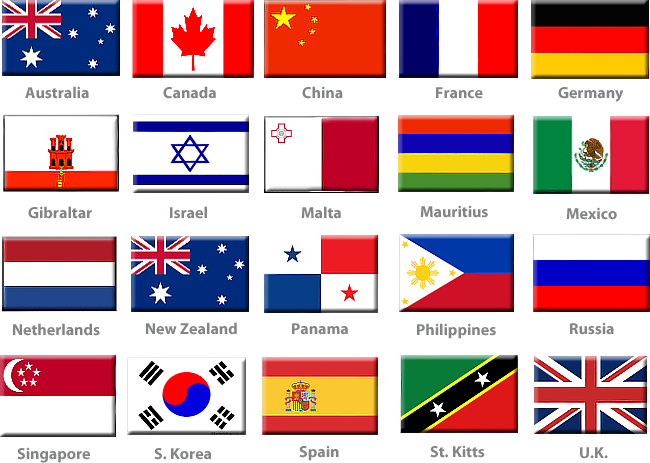

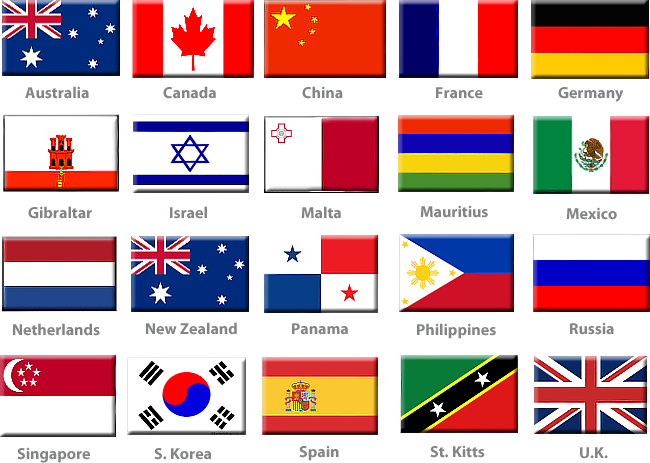

Ezic is compatible with national and international processors to be able to service the wide range of needs our Resellers and Merchants have.

International Certified Processors

Customers

Our client base includes:

Our markets include:

- Brick and Mortar

- E-commerce

- Wireless

Our gateway enables our clients to offer their Merchants a single secure solution to meet all of their payment processing needs.

Merchants are able to accept and process:

Security

Fraud Barricade™

Ezic offers superior fraud protection through its proprietary fraud scrubbing tool, Fraud Barricade™.

Advanced and configurable industry standard CVV2 and AVS

Our Merchant Protocol Interface holds VISA CISP (Cardholder Information Security Program), MasterCard SDP (Secure Data Protection Service), and Visa (Verified by Visa) certifications. The combination of high-standard certifications provides unparalleled network-level security and fraud restrictions which minimize the risk of fraud for merchants.

Unparalleled Network-Level Security

Ezic provides the most formidable defense available to combat both network-level intrusion and "denial of service" attacks with system wide access control, server monitoring, and intrusion detection and prevention.

Uncompromising Access Security

Keeping hackers out and controlling internal user access is key to preventing fraud. Performed at every access level, Ezic's access level includes:

- Configurable payment success controls

- A full and unalterable audit trail for all system change actions and requests

- Configurable internal permissions controls

- Secure, triple credential authentication login process

Chargeback Lookout™

Stay in control of your chargebacks with an automatic report of chargeback data from your bank that ties back to the original transaction. Resellers can closely monitor chargebacks for all merchants under their one gateway login.

PCI Compliance

PCI-DSS is a multifaceted security standard intended to help organizations proactively protect customer account data. Ezic goes through an annual audit to maintain this level of security.

On the merchant side of PCI Compliance, we offer a Hosted Payment Form, a secure payment form hosted on the Ezic servers to take the risk and burden of PCI Compliance off of the merchant.

Technology

Our customers build strong portfolios of high volume merchants that demand high performance solutions.

- Modularity: The gateway is divided into separate modules that can be individually serviced and upgraded without interruptions to the rest of the system.

- 99.99% Uptime: Since its inception in 1999, Ezic has exceeded this benchmark.

- Stand-by/Fallback Systems: Standardized and redundant hardware with on-site spares minimize recovery-time for even the most catastrophic disaster scenario.

- Storage Arrays: These dedicated arrays keep generational backups of every server stack, allowing rapid reconstruction of any server stack.

- Redundancy: Parallel processing and redundant systems serve to simultaneously provide on-demand scalability and eliminate single points of failure.

- Secure: The network is protected by firewalls and hosted in a SAS 70 certified facility with 24-hour staffing and monitoring.

- Scalable & Flexible: System capacity scales linearly with the addition of new hardware, with no changes to the underlying architecture.